3D printing market to grow to $4bn (USD) by 2025

According to research in the '3D Printing 2014-2025: Technologies, Markets, Players' report, IDTechEx have forecast that the market for 3D printing equipment, materials and software will grow from about $1.5bn (USD) this year to $4bn (USD) in 2025. While the automotive industry will remain the largest client sector, growth will be led by the sectors transitioning towards the use of 3D printing for final product applications, including medical/dental sectors, jewellery and design art manufacturers and the aerospace industry.

Through to 2025, the Stereolithography (SLA) and Fused Deposition Modeling (FDM) approaches will continue to enjoy the majority of the share of the market, although significant growth will occur with the laser and electron beam technologies, albeit from a much smaller installed base.

Market growth for 3D printing will not be monotonic however as the technologies ultimately lock into the capital expenditure cycles associated to many of the industries it serves, including in particular the aerospace and automotive industries which together account for a significant proportion of 3D printer sales. As penetration of these markets continues and increases, fluctuations in sales will eventually manifest and the market is expected to fall somewhat in the near term as a number of capital expenditure rounds come to an end.

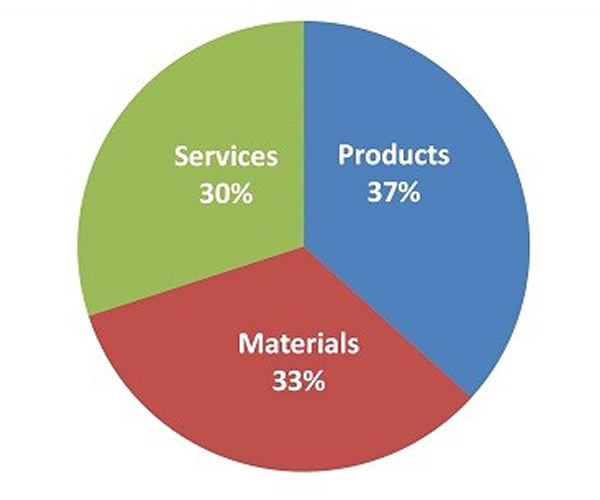

A breakdown of the market according to printer sales, services and material sales for 2014

The number of 3D printer manufacturers has seen relatively steady growth since the technology was first commercialised in 1986. There have been occasional closures, sometimes driven by litigation rather than lack of revenues/potential revenues. There has also been some acquisition activity, particularly over recent years, as the larger companies (notably 3D Systems and Stratasys) have sought to increase their range of technology offerings to clients, opening up new market opportunities. Key patents are expiring over the next few years which will fuel more new entrants - and M&A activity for the biggest who seek to retain their market share.